QuickBooks is a popular accounting software developed by Intuit, designed primarily for small and medium-sized businesses. It offers a range of features to help businesses manage their finances

QuickBooks is widely used due to its user-friendly interface, comprehensive features, and integration capabilities with other business tools and services.

Connecting QuickBooks to Wiresk enhances financial and operational management by automating tasks and improving data accuracy.

Possible actions in Wiresk:

- With scheduled Triggers like Check Updated Invoice and Check New Invoice, you can automatically monitor and update changes in QuickBooks.

- Use Wiresk’s Query Builder and Get Records by Search String to quickly locate specific records, such as invoices or customer details.

- Manage records efficiently with actions like Create, Update Record, and Upsert. You can add new invoices, modify customer information, or handle credit card transactions (Create Credit Card).

- Handle files with Upload File and Download, enabling you to attach documents to records or retrieve them for audits or client requests.

- Automate communications with Send Mail, ensuring timely updates about invoices or payments.

- Add context to records using Create File Note or remove outdated data with the Delete Method. The Find and List Methods help locate specific records or generate lists for analysis, providing better insights into your financial data.

Explore the available functionalities through the QuickBooks API documentation.

1 – Connect Quickbooks to Wiresk Copy Link

A connection to your Quickbooks account is needed so we can sync it with our platform.

There are two ways to connect your app to Wiresk:

▪️ In “My apps” section, where you can manage your connections (select or create your group first to get access to this section, refer to the Group system ).

▪️ While building your Flow, you can easily establish a connection to your app directly within the Flow builder. This can be done during the setup of either a Trigger or a Method.

In this documentation, we will explain how to create a connection in “My apps” section, it is essentially the same as when creating it on-the-go.

Add Quickbooks app in Wiresk Copy Link

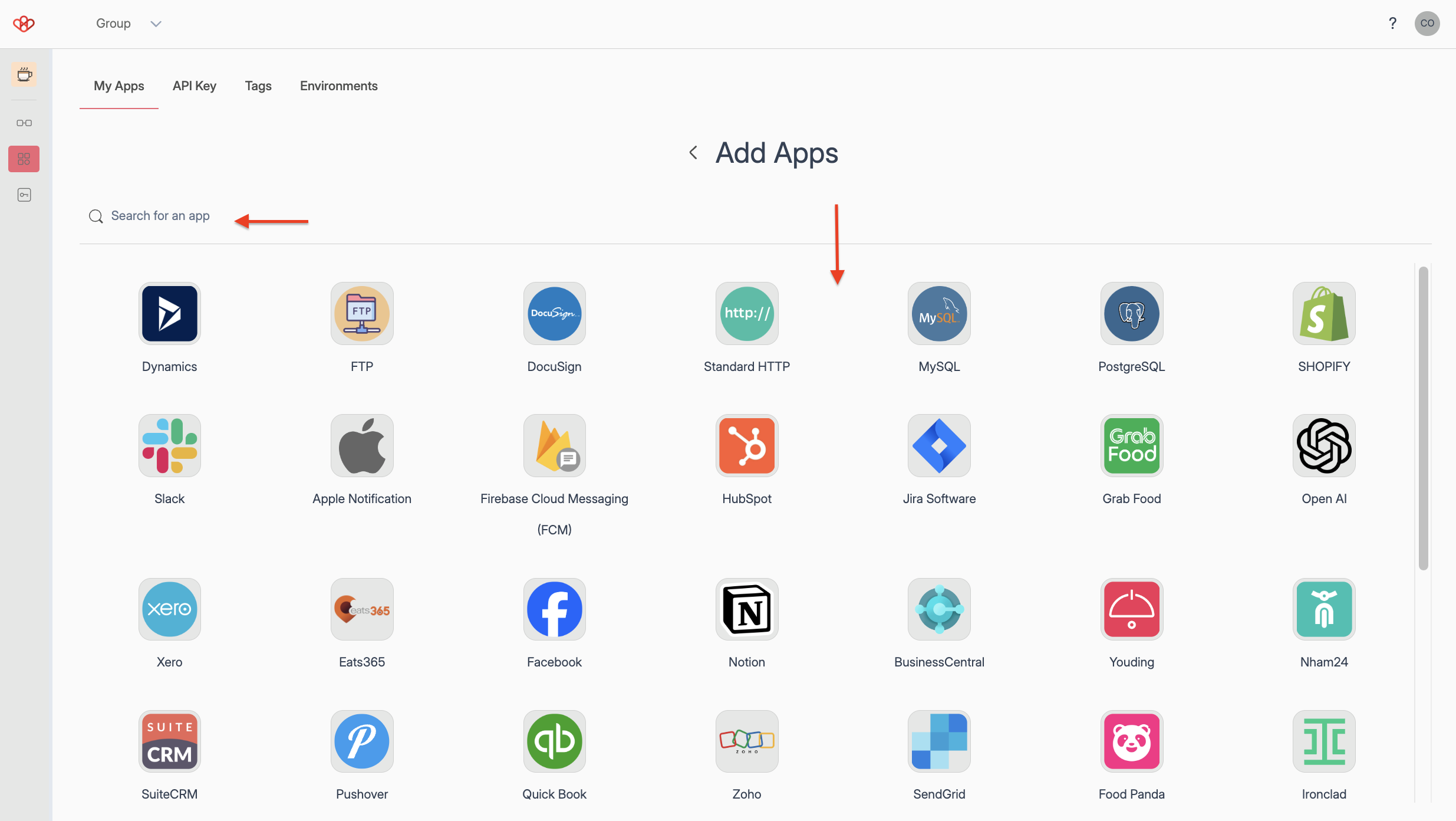

- On the left panel of Wiresk user interface, go to “My apps” and click on the (+) button.

- Search “Quickbooks” in the search field or scroll down the list of apps and choose the Quickbooks icon.

Connect Quickbooks via an OAuth connection: Copy Link

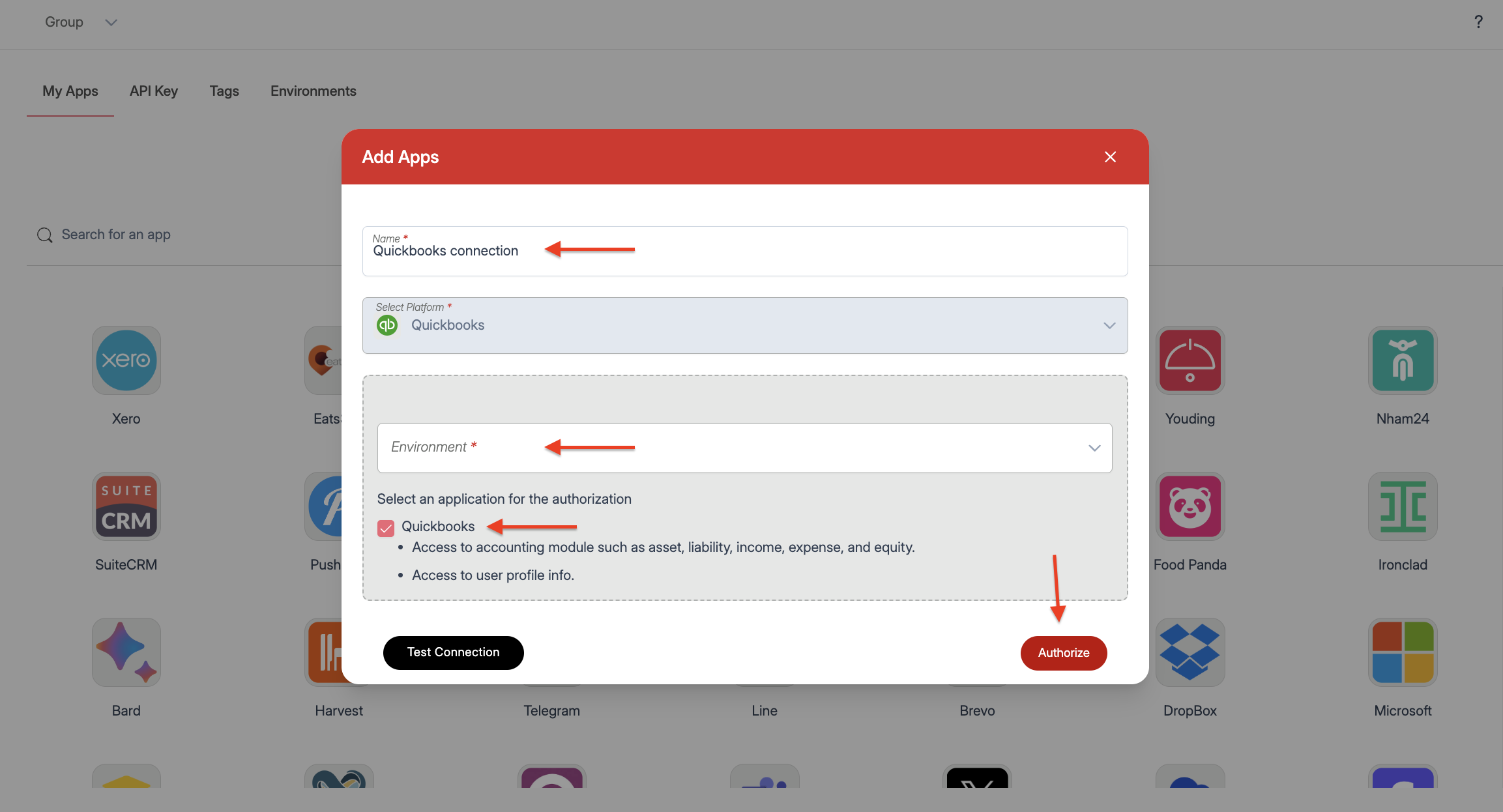

- In the prompted screen, give a name to your connection, e.g., “Quickbooks Connection”.

- Select the environment of your account (Development or Production).

- Select the checkbox Quickbooks (permissions for authorization).

- Select the “Authorize” button. You will be redirected to Quickbooks connection page.

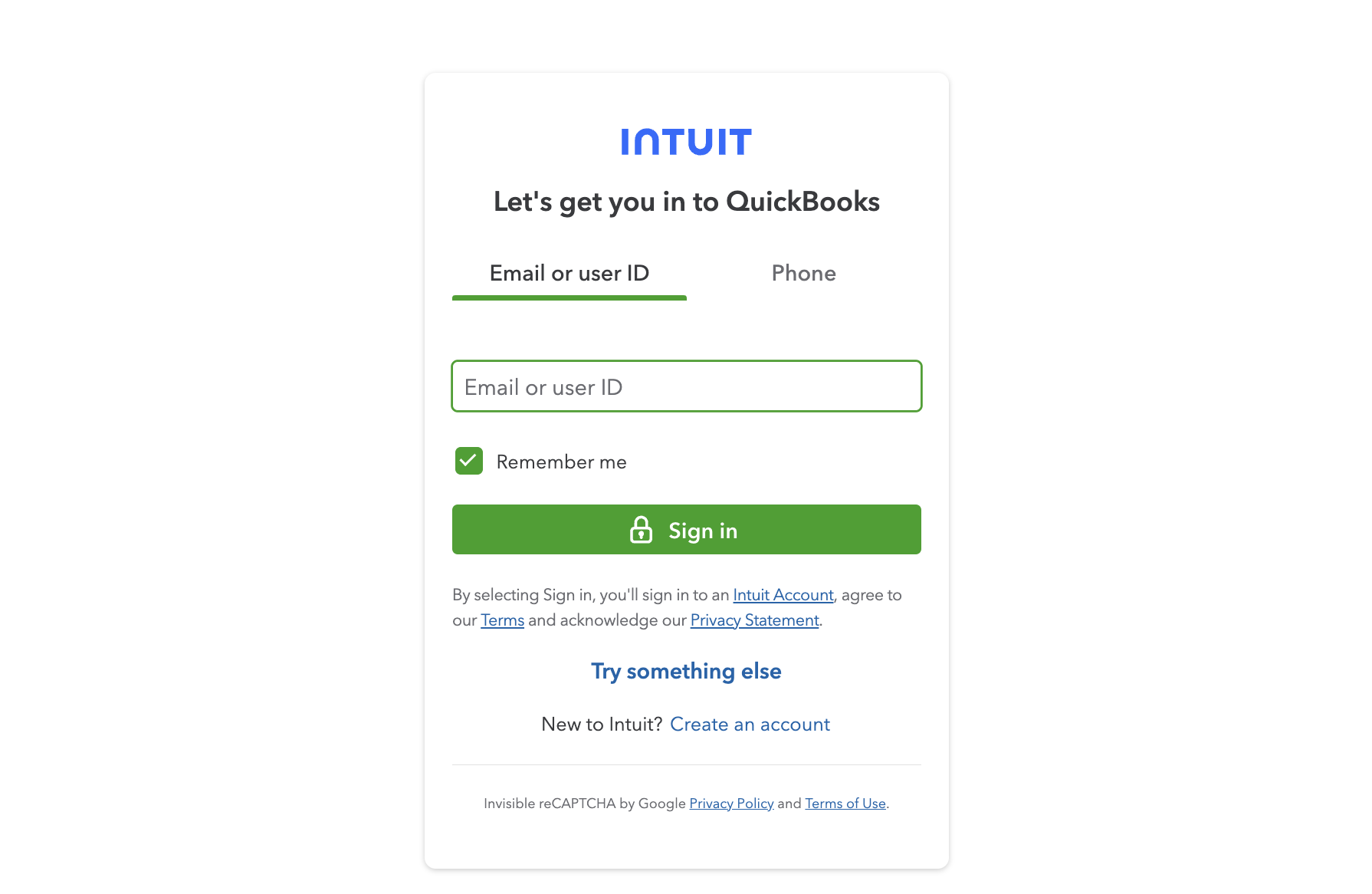

- If you’ve already logged into your QuickBooks account, the connection will happen automatically, and you’ll be redirected back to Wiresk’s connection screen. If you haven’t logged in yet, you’ll need to connect to your QuickBooks account by entering your credentials and completing the identity verification steps.

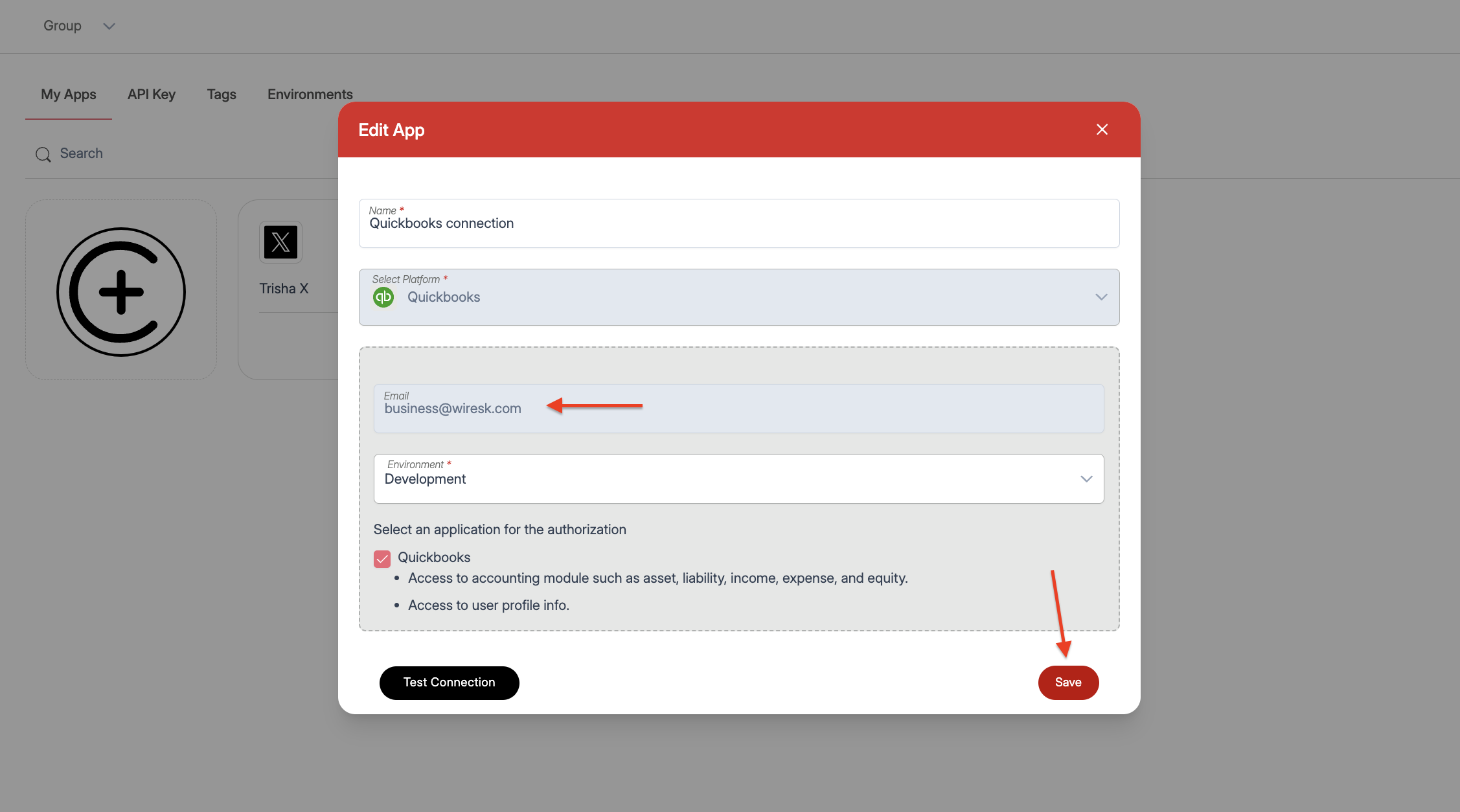

- Back to the “Add Apps” screen, you can notice a new field “Email” with your Quickbooks email account.

- Now select the “Save” button. Voila! Your Quickbooks app connection is ready. You can now use it to build your Flows.

2 – Create your automated Flows with Quickbooks Copy Link

Now that Quickbooks is linked to Wiresk, you’re ready to start building Flows.

How to create a Flow (select to expand ↓ )

- Select your Group, then on the Flow management screen click on “Create Flow”.

A – Select the Trigger

- Name the Flow that you want to create.

- Add your Trigger by clicking on the red plus (+) Add button.

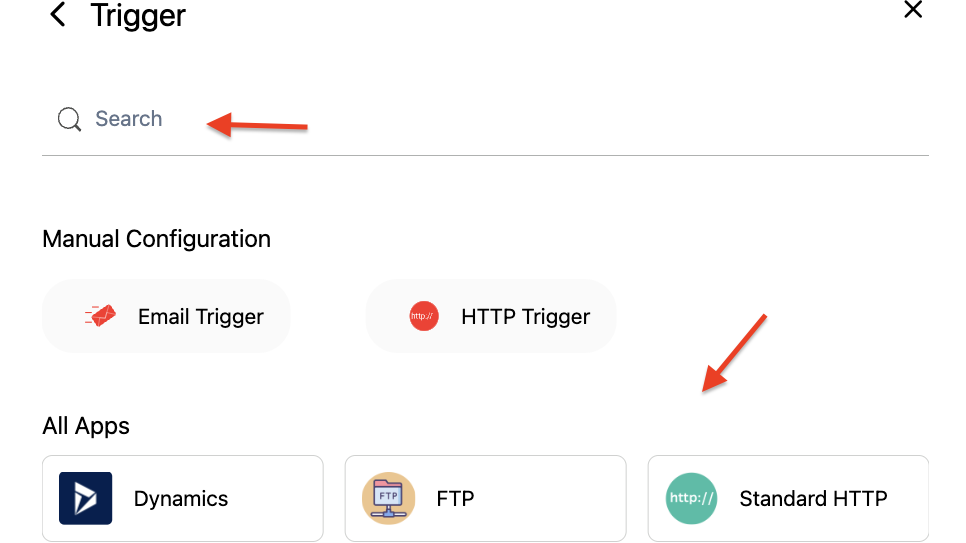

- On the Trigger selection screen, search your app or select it from the list below the screen.

- Select your preferred Trigger on the next screen and customize its settings (for Quickbooks Triggers, refer to the Trigger settings below).

As mentioned in “How to connect your app to Wiresk” above, during your Trigger settings, you can create a new connection to your apps at this stage.

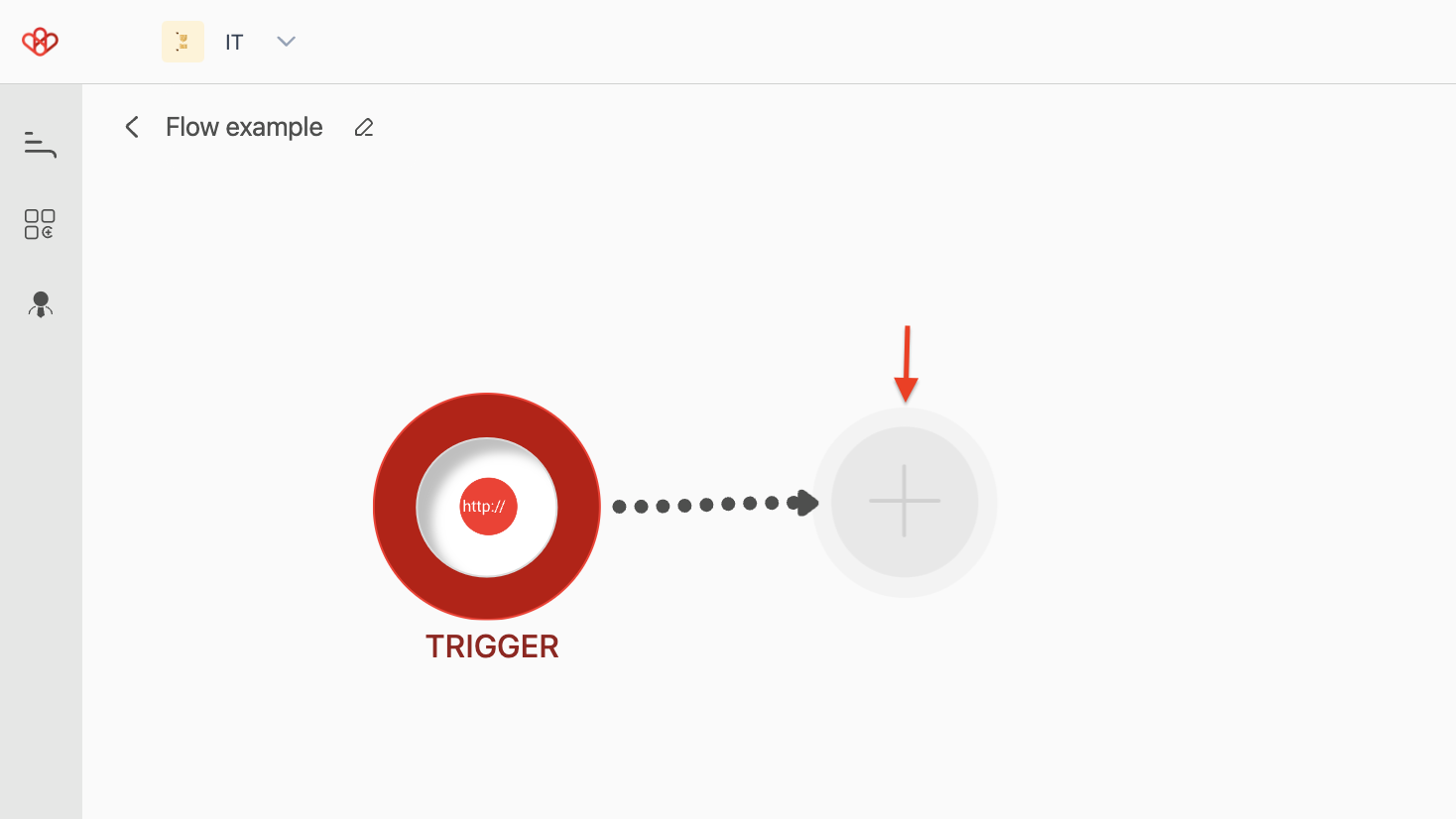

B – Add an HTTP Trigger to your Flow

An HTTP Trigger allows you to manually activate your Flows.

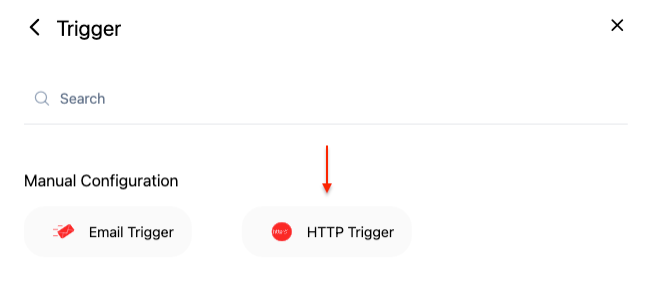

- Click on the red plus button (+) again to add a Trigger for testing your Flow, then click on the button “HTTP Trigger”.

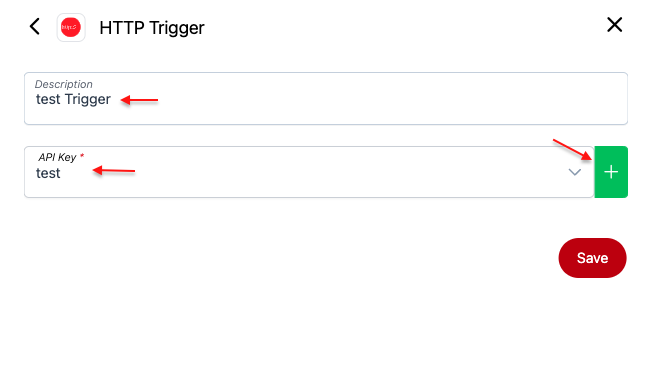

- Write a description and select your API key or create a new one.

- Click on save. Now you can use your HTTP Trigger to Manually run your Flow.

C – Add a Method to your Flow

The Method will perform a specific task on a particular app or service you’ve connected to Wiresk like get info or send emails.

You can add at least 1 or multiple Methods for complex Flows (a maximum of 255 Methods).

- On the Flow builder screen, click on the plus button (+) next to the Trigger icon.

- Search or scroll down to select your apps Methods, then configure it settings. For Quickbooks Methods, see Methods list and settings in the step below.

D – Add Wiresk Tools to your Flow

If you want to build a complex Flow, Wiresk offers a selection of tools at your disposal. Refer to Wiresk’s Tools

To add Tools in your Flow, Follow the same step as adding the Methods. On the Flow builder screen, click on the plus button (+) then just click on the “Tool” tab and select the Tool that you want to add.

3 – Quickbooks Triggers Copy Link

What will start your automation…

Recurrence rule or scheduler settings Copy Link

Setting up the recurrence rule or scheduler of your Trigger (if the Trigger is not a Webhook):

- Regular intervals will monitor your Trigger by intervals in minute

- Daily recurrence will monitor your Trigger by day and hour

- Monthly recurrence will monitor your Trigger every month on a defined date and hour

- Yearly recurrence will monitor your Trigger on a specific date and hour every year

- Specific dates will start your Trigger on specific dates

Get Sample Copy Link

After setting up the Trigger parameters (refer to how to define your parameters in the steps below), click on “Get sample”.

The “Get sample” allows you to extract a subset of data for validation. The data will be used to MAP your Method parameters according to your Flow. Refer to FIELD MAPPING documentation.

Scheduled Triggers List and Settings Copy Link

These Triggers will start your Flow automatically at a specific time or intervals instead of being triggered real-time event (Webhooks).

Check Updated Invoice Copy Link

Configuration Table:

| Name* | Check Updated Invoice |

| Connection* | Select your connection or create one. |

| Time out | You can additionally set the Trigger duration to limit the information processed per execution to optimize performance and resource usage. |

| Recurrence rule/scheduler* | Set up your recurrence rule. |

| Parameters | |

| Include Previous Invoices | Selecting Yes retrieve all existing invoices. Choosing No shows only invoices created since the last time the flow was executed. |

| Preview Data | In this tab, you can preview the retrieved data. In specific Trigger instances, data can only be previewed when it is available for retrieval. If no event occurs from the Trigger, a message “No data available”, or “Cannot read properties of null ” will be displayed. |

(*) required field

Before saving your Trigger, don’t forget to use “Get Sample”.

Get Records by Search String Copy Link

The query operation is similar to a pared down SQL query select statement, but with a few limitations.

See Quickbooks documentation on Query operation and syntax.

Configuration Table:

| Name* | Get Records by Search String |

| Connection* | Select your connection or create one. |

| Time out | You can additionally set the Trigger duration to limit the information processed per execution to optimize performance and resource usage. |

| Recurrence rule/scheduler* | Set up your recurrence rule. |

| Parameters | |

| Query String | Example of Query: select * from Invoice where id = ‘239’ |

| Preview Data | In this tab, you can preview the retrieved data. In specific Trigger instances, data can only be previewed when it is available for retrieval. If no event occurs from the Trigger, a message “No data available”, or “Cannot read properties of null ” will be displayed. |

(*) required field

Before saving your Trigger, don’t forget to use “Get Sample”.

Check New Invoice Copy Link

Configuration Table:

| Name* | Check New Invoice |

| Connection* | Select your connection or create one. |

| Time out | You can additionally set the Trigger duration to limit the information processed per execution to optimize performance and resource usage. |

| Recurrence rule/scheduler* | Set up your recurrence rule. |

| Parameters | |

| Include Previous Invoices | Selecting Yes retrieve all existing invoices. Choosing No shows only invoices created since the last time the flow was executed. |

| Preview Data | In this tab, you can preview the retrieved data. In specific Trigger instances, data can only be previewed when it is available for retrieval. If no event occurs from the Trigger, a message “No data available”, or “Cannot read properties of null ” will be displayed. |

(*) required field

Before saving your Trigger, don’t forget to use “Get Sample”.

Retrieve records using Wiresk’s Query Builder Copy Link

A Query Builder allows you to create complex SQL queries without having to write any code.

This allows non-technical users to easily access and analyze data with a graphical user interface.

See how to use Wiresk’s Query Builder.

✓ When This Trigger is running, the result of the Query can be use to Map your Methods.

Configuration Table:

| Name* | Retrieve Records using Wiresk’s Query Builder |

| Connection* | Select your connection or create one Refer to how to create a connection. |

| Time out | You can additionally set the Trigger duration to limit the information processed per execution to optimize performance and resource usage. |

| Recurrence rule/scheduler* | Set up your recurrence rule |

| Parameters | |

| Entity* (Set of data that contain records) | Select the Entity where the data records are located. For example, “Invoice“, “Item“, or “Payment“. |

| Related Entities | This section allows you to link related entities in Quickbooks to the primary entity you are querying. Clicking “Link an entity” will let you select and define relationships between the primary entity and its related entities. |

| Configure Filter | This tab enables you to define specific criteria to narrow down the records being retrieved. |

| Configure grouping | This tab allows you to group the retrieved records based on certain attributes or fields. |

| Configure Columns | Configure which columns or fields of data will be retrieved and included in the output. Preview Data: To visualize the records. You must select at least 1 Columns to get the Preview Dat. If you get this message:” Cannot convert undefined or null to object”, it means there is no records. Number of records:10 By default, 10 records will be shown. Begin at record:0 The display starts at record 0. Edit Columns Customize which columns are displayed and retrieved. Minimum 1 column, maximum 50 columns. Configure Sorting This option is for sorting the data in the columns by Ascending or descending order. |

(*) required field

Before saving your Trigger, don’t forget to use “Get Sample”.

Get All Records of an Entity Copy Link

Configuration Table:

| Name* | Get All Records of an Entity |

| Connection* | Select your connection or create one. |

| Time out | You can additionally set the Trigger duration to limit the information processed per execution to optimize performance and resource usage. |

| Recurrence rule/scheduler* | Set up your recurrence rule. |

| Parameters | |

| Entity* (Set of data that contain records) | Select the Entity to retrieve records. Invoice, Bill, Journal Entry, Deposit, Credit Memo, Purchase Order, Customer, Vendor, Account, Purchase, Time Activity, Refund Receipt, Sales Receipt, Estimate, Payment, Item, File. |

| Page | Define the page number of retrieve records. |

| Limit | Define the maximum of records per page. |

| Preview Data | In this tab, you can preview the retrieved data. In specific Trigger instances, data can only be previewed when it is available for retrieval. If no event occurs from the Trigger, a message “No data available”, or “Cannot read properties of null ” will be displayed. |

(*) required field

Before saving your Trigger, don’t forget to use “Get Sample”.

4 – Quickbooks Methods Copy Link

What your automation will do…

Methods List and Settings Copy Link

CREATE Copy Link

This Method allows you to create:

Invoice, Item, Payment, Journal Entry, Bill, Sale Receipt, Estimate, Deposit, Credit Memo, Purchase Order, Customer, Vendor, Account, Purchase, Time Activity, Refund Receipt.

Configuration Table:

Input Options:

- Input: Allows dynamic inputs, e.g., from a Trigger or from Step responses. Input tab>uncheck “Show recommended” to see all fields).

- Default Value: You can specify a fixed attribute.

| Name* | Create |

| Connection* | Select your connection or create one. |

| Entity* (Set of data that contain records) | Select the available Entity to create records: Invoice, Item, Payment, Journal Entry, Bill, Sale Receipt, Estimate, Deposit, Credit Memo, Purchase Order, Customer, Vendor, Account, Purchase, Time Activity, Refund Receipt. |

(*) required field

Configuration table for each Entity:

Create Invoice Copy Link

Note:

▪️ Have at least one Line a sales item or inline subtotal.

▪️ The

DocNumber attribute is populated automatically by the data service if not supplied.▪️ If

ShipAddr, BillAddr, or both are not provided, the appropriate customer address from the referenced Customer object is used to fill those values.Tip: For Any Reference fields like Customer reference, Account reference or Vendor reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Invoice API Reference.

| MAP FIELDS [+ Add Field] Select fields from a list, to configure the invoice creation. Additional fields: Sales Term Reference, Transaction Date, Customer Memo, Transaction Tax Detail, Deposit, Line, DocNumber. | |

| Customer Reference* | A customer is a consumer of the service or product that your business offers. Reference to a customer or job. Customer ID*: The ID for the referenced customer. Name: Name derived from the field that holds the common name of that customer. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| Line* Invoice line object. If the transaction is taxable there is a limit of 750 lines per transaction. | [⊕ Element][⊕ Map] Add fields or Map it from a Data Source. See Field Mapping. Additional Line can be added as elements. Element 1: Represents the first Invoice Line. Detail Type*: Possible choices for each line: Sales Item Line DetailGroup Line DetailAmount*: The amount of the line item. The [+ Add Field] button allows to add fields corresponding to the Detail Type. Description: Free form text description of the line item that appears in the printed record. Max character: 4000. Line Number: Specifies the position of the line in the collection of transaction lines. Sale Item Line Detail [+ Add Field] add more fields in Sale Item Line Detail: _ Quantity: Number of items for the line. _ Unit Price: Unit price of the subject item as referenced by ItemRef. _ Discount Amount: Fixed discount. _ Discount Rate: The discount rate applied to this line. If both Discount are provided, Discount Rate takes precedence and Discount Amount is recalculated by QuickBooks services based on amount of Discount Rate. _ Item Reference: Reference to an Item object. [+ Add Field] add more fields in Item reference: ___ Item ID: The ID for the referenced item. ___ Name: Name derived from the field that holds the common name of that item. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘._ Tax Code Reference: Reference to the Tax Code for this item. [+ Add Field] add more fields in Tax Code Reference: ___ Value: The ID for the referenced Tax Code. ___ Name: Name derived from the field that holds the common name of that Tax Code. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| ADDITIONAL FIELDS | |

| Sales Term Reference | Reference to the sales term associated with the transaction. Value: The ID for the referenced Sales Term. |

| Transaction Date | The date entered by the user when this transaction occurred. yyyy/MM/dd is the valid date format. For posting transactions, this is the posting date that affects the financial statements. If the date is not supplied, the current date on the server is used. |

| Customer Memo Max 1000 chars. | Value: User’s message to the customer; this message is visible to the end user on their transactions. |

| Transaction Tax Detail | This data type provides information for taxes charged on the transaction as a whole. It captures the details sales taxes calculated for the transaction based on the tax codes referenced by the transaction. Transaction Tax Code Reference: _ Value: Reference to the transaction tax code. See Global tax model for more information about this element. |

| Deposit | The deposit made towards this invoice. |

| DocNumber | This field stores the transaction’s reference number. You can specify a custom value during creation. If none is provided this field is populated based on the setting of Preferences: CustomTxnNumber.▪️ If UseCustomTxnNumbers preference is enabled: You can provide a custom DocNumber. Duplicates are not allowed.▪️ If no custom value is given, DocNumber is null.▪️ If UseCustomTxnNumbers is disabled: DocNumber is automatically generated by the system.Cash/CreditCard: Duplicates always cause an error. Check: Duplicates cause an error only if the WarnDuplicateCheckNumber preference is enabled.Tips: Check the UseCustomTxnNumbers preference before setting DocNumber manually.Allow Duplicates: Use the include=allowduplicatedocnum query parameter to allow duplicate DocNumber (not recommended).Default Sort Order: Ascending order. |

(*) required field

Response sample from Create Invoice

{

"Invoice": {

"TxnDate": "2015-07-24",

"domain": "QBO",

"PrintStatus": "NeedToPrint",

"TotalAmt": 100.0,

"Line": [

{

"LineNum": 1,

"Amount": 100.0,

"SalesItemLineDetail": {

"TaxCodeRef": {

"value": "NON"

},

"ItemRef": {

"name": "Services",

"value": "1"

}

},

"Id": "1",

"DetailType": "SalesItemLineDetail"

},

{

"DetailType": "SubTotalLineDetail",

"Amount": 100.0,

"SubTotalLineDetail": {}

}

],

"DueDate": "2015-08-23",

"ApplyTaxAfterDiscount": false,

"DocNumber": "1069",

"sparse": false,

"ProjectRef": {

"value": "39298034"

},

"Deposit": 0,

"Balance": 100.0,

"CustomerRef": {

"name": "Amy's Bird Sanctuary",

"value": "1"

},

"TxnTaxDetail": {

"TotalTax": 0

},

"SyncToken": "0",

"LinkedTxn": [],

"ShipAddr": {

"City": "Bayshore",

"Line1": "4581 Finch St.",

"PostalCode": "94326",

"Lat": "INVALID",

"Long": "INVALID",

"CountrySubDivisionCode": "CA",

"Id": "109"

},

"EmailStatus": "NotSet",

"BillAddr": {

"City": "Bayshore",

"Line1": "4581 Finch St.",

"PostalCode": "94326",

"Lat": "INVALID",

"Long": "INVALID",

"CountrySubDivisionCode": "CA",

"Id": "2"

},

"MetaData": {

"CreateTime": "2015-07-24T10:33:39-07:00",

"LastUpdatedTime": "2015-07-24T10:33:39-07:00"

},

"CustomField": [

{

"DefinitionId": "1",

"Type": "StringType",

"Name": "Crew #"

}

],

"Id": "238"

},

"time": "2015-07-24T10:33:39.11-07:00"

}

Create Item Copy Link

Tip: For Any Reference fields like Customer reference, Account reference or Vendor reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Item API Reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Item creation. Additional fields: Active, SKU, Unit Price, TrackQtyOnHand, QtyOnHand, AssetAccountRef, InvStartDate, ExpenseAccountRef. | |

| Name* Maximum of 100 chars | Name of the item. This value must be unique, at least one character in length, and cannot include tabs, new lines, or colons. Required for create. |

| IncomeAccountRef* | Reference to the posting account, that is, the account that records the proceeds from the sale of this item. Must be an account with account type of Sales of Product Income.Account ID*: The ID for the referenced Income Account. Name: Name derived from the field that holds the common name of that account. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| Type* | Classification that specifies the use of this item:Inventory - Service - Non inventorySee the description at the top of the Item entity page for details about supported item types. |

| ADDITIONAL FIELDS | |

| Active | True – False Inactivating an item is achieved by setting the Active attribute to false. |

| SKU | The stock keeping unit (SKU) for this Item. This is a company-defined identifier for an item or product used in tracking inventory. maximum of 100 chars. minorVersion: 4 |

| Unit Price | Price of the item. |

| TrackQtyOnHand | True - False |

| QtyOnHand | Current quantity of the Inventory items available for sale.Not used for Service or NonInventory type items.Required for Inventory type items. |

| AssetAccountRef | Reference to the Inventory Asset account that tracks the current value of the inventory. If the same account is used for all inventory items, the current balance of this account will represent the current total value of the inventory. Must be an account with account type of Other Current Asset. Use Account.Id and Account.Name from that object for AssetAccountRef.value and AssetAccountRef.name, respectively. Required for Inventory item types.Account ID*: The ID for the referenced asset account. Name: Name derived from the field that holds the common name of that account. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| InvStartDate | Date of opening balance for the inventory transaction. Required when creating an Item.Type=Inventory. Required for Inventory item types.Local timezone: YYYY-MM-DD UTC: YYYY-MM-DDZ Specific time zone: YYYY-MM-DD+/-HH:MMThe date format follows the XML Schema standard. |

| ExpenseAccountRef | Reference to the expense account used to pay the vendor for this item. Must be an account with account type of Cost of Goods Sold.Account ID*: The ID for the referenced expense account. Name: Name derived from the field that holds the common name of that account. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

(*) required field

Response sample from Create Item

{

"Item": {

"FullyQualifiedName": "Garden Supplies",

"domain": "QBO",

"Id": "19",

"Name": "Garden Supplies",

"TrackQtyOnHand": true,

"UnitPrice": 0,

"PurchaseCost": 0,

"QtyOnHand": 10,

"IncomeAccountRef": {

"name": "Sales of Product Income",

"value": "79"

},

"AssetAccountRef": {

"name": "Inventory Asset",

"value": "81"

},

"Taxable": false,

"sparse": false,

"Active": true,

"SyncToken": "0",

"InvStartDate": "2015-01-01",

"Type": "Inventory",

"ExpenseAccountRef": {

"name": "Cost of Goods Sold",

"value": "80"

},

"MetaData": {

"CreateTime": "2015-12-09T11:12:39-08:00",

"LastUpdatedTime": "2015-12-09T11:12:41-08:00"

}

},

"time": "2015-12-09T11:12:39.748-08:00"

}

Create Payment Copy Link

Tip: For Any Reference fields like Customer reference, Account reference or Vendor reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Payment API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Payment creation. Additional fields: Currency Reference, Project Reference, Line. | |

| Total amount* | Indicates the total amount of the transaction. This includes the total of all the charges, allowances, and taxes. If you process a linked refund transaction against a specific transaction, the totalAmt value won’t change. It will remain the same. However, voiding the linked refund will change the totalAmt value to 0. |

| Customer reference* | Reference to a customer or job. Customer ID*: The ID for the referenced customer. Name: Name derived from the field that holds the common name of that customer. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| ADDITIONAL FIELDS | |

| Currency Reference | Reference to the currency in which all amounts on the associated transaction are expressed. This must be defined if multi-currency is enabled for the company. Read more about multi-currency support here. Currency ID: A three letter string representing the ISO 4217 code for the currency. For example, USD, AUD, EUR. Name: The full name of the currency. |

| Project reference | Reference to the Project ID associated with this transaction. Project ID: The ID for the referenced Project. Name: Name derived from the field that holds the common name of that project. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| Line Zero or more transactions accounting for this payment. | [⊕ Element][⊕ Map] Add fields or Map it from a Data Source. See Field Mapping. Additional Payment Line can be added as elements. Element 1: Represents the first Payment Line. Amount*: The amount of the line item. Linked Transaction*: Transaction to which the current entity is related. For example, a billpayment line links to the originating bill object for which the billpayment is applied._ Transaction ID*: Transaction id of the related transaction. _ Transaction Type*: Possible values: Expense Check Credit Card Credit Journal Entry Credit Memo Invoice |

(*) required field

Response sample from Create Payment

{

"Payment": {

"SyncToken": "0",

"domain": "QBO",

"DepositToAccountRef": {

"value": "4"

},

"UnappliedAmt": 25.0,

"TxnDate": "2014-12-30",

"TotalAmt": 25.0,

"ProjectRef": {

"value": "39298034"

},

"ProcessPayment": false,

"sparse": false,

"Line": [],

"CustomerRef": {

"name": "Red Rock Diner",

"value": "20"

},

"Id": "154",

"MetaData": {

"CreateTime": "2014-12-30T10:26:03-08:00",

"LastUpdatedTime": "2014-12-30T10:26:03-08:00"

}

},

"time": "2014-12-30T10:26:03.668-08:00"

}

Create Journal Entry Copy Link

▪️ There are at least one pair of lines, a debit and a credit, called distribution lines.

▪️ Each distribution line has an account from the Chart of Accounts. Query the Account resource for a listing of the Chart of Accounts.

▪️ The total of the debit column equals the total of the credit column.

When you record a transaction with a JournalEntry object, the QuickBooks Online UI labels the transaction as JRNL in the register and as General Journal on reports that list transactions.

Tip: For Any Reference fields like Customer Reference, Account Reference or Vendor Reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Journal Entry API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Journal Entry creation. Additional fields: DocNumber. | |

| Line* Individual line items of a transaction. There must be at least one pair of Journal Entry Line elements, representing a debit and a credit, called distribution lines. Set Line Detail Type to Journal Entry Line for both lines. | [⊕ Element][⊕ Map] Add fields or Map it from a Data Source. See Field Mapping. Additional Journal Entry Line can be added as elements. Element 1: Represents the first Journal Entry Line. Detail Type*: Set to Journal Entry Line Detail.Amount*: The amount of the line item. Journal Entry Line Detail*: _ Posting Type*: Indicates whether this Journal Entry line is a Debit or Credit. _ Account Reference*: Reference to the account associated with this line. ___ Value*: The ID for the referenced account. ___ Name: Name derived from the field that holds the common name of that account. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘.⚠️ If this account has same location as specified in the transaction by the TransactionLocationType attribute and the same VAT as in the line item TaxCodeRef attribute, then this account is used.⚠️ If there is a mismatch, then the account from the account category list that matches the transaction location and VAT is used. ⚠️ If this account is not present in the account category list, then a new account is created with the new location, new VAT code, and all other attributes as in the default account. Description: Free form text description of the line item that appears in the printed record. Max 4000 chars. |

| ADDITIONAL FIELDS | |

| DocNumber | This field stores the transaction’s reference number. You can specify a custom value during creation. If none is provided this field is populated based on the setting of Preferences: CustomTxnNumber.▪️ If UseCustomTxnNumbers preference is enabled: You can provide a custom DocNumber. Duplicates are not allowed.▪️ If no custom value is given, DocNumber is null.▪️ If UseCustomTxnNumbers is disabled: DocNumber is automatically generated by the system.Cash/CreditCard: Duplicates always cause an error. Check: Duplicates cause an error only if the WarnDuplicateCheckNumber preference is enabled.Tips: Check the UseCustomTxnNumbers preference before setting DocNumber manually.Allow Duplicates: Use the include=allowduplicatedocnum query parameter to allow duplicate DocNumber (not recommended).Default Sort Order: Ascending order. |

(*) required field

Response sample from Create Journal Entry

{

"time": "2015-06-29T12:45:32.183-07:00",

"JournalEntry": {

"SyncToken": "0",

"domain": "QBO",

"TxnDate": "2015-06-29",

"sparse": false,

"Line": [

{

"JournalEntryLineDetail": {

"PostingType": "Debit",

"AccountRef": {

"name": "Truck:Depreciation",

"value": "39"

}

},

"DetailType": "JournalEntryLineDetail",

"Amount": 100.0,

"Id": "0",

"Description": "nov portion of rider insurance"

},

{

"JournalEntryLineDetail": {

"PostingType": "Credit",

"AccountRef": {

"name": "Notes Payable",

"value": "44"

}

},

"DetailType": "JournalEntryLineDetail",

"Amount": 100.0,

"Id": "1",

"Description": "nov portion of rider insurance"

}

],

"Adjustment": false,

"Id": "228",

"TxnTaxDetail": {},

"MetaData": {

"CreateTime": "2015-06-29T12:45:32-07:00",

"LastUpdatedTime": "2015-06-29T12:45:32-07:00"

}

}

}

Create Bill Copy Link

When creating a bill, only certain transaction types can be linked. The most commonly supported transaction types include:

▪️ BillPaymentCheck – A payment made by check to pay the bill.

▪️ BillPaymentCreditCard – A payment made by credit card to pay the bill.

▪️ CreditMemo – A credit memo applied to the bill.

▪️ JournalEntry – A journal entry affecting the bill.

Transactions like Invoice and Deposit are not typically linked to a bill because a bill represents an expense or liability, while invoices are accounts receivable (money owed to you, not by you). Deposits usually relate to received funds, not expenses.

Tip: For Any Reference fields like Customer Reference, Account Reference or Vendor Reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Bill API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Bill creation. Additional fields: Currency Reference, Ap Account Reference, Sales Term Reference, Linked Transaction, DocNumber. | |

| Vendors Reference* | Reference to the vendor for this transaction. [+ Add Field] add more fields: Value: The ID for the referenced vendor. Name: Name derived from the field that holds the common name of that vendor. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| Line* | [⊕ Element][⊕ Map] Add fields or Map it from a Data Source. See Field Mapping. Additional Line can be added as elements. Element 1: Represents the first Line. Detail Type*: Possible choices for each line: Account Based Expense Line Detail – Item based Expense Line DetailAmount*: The amount of the line item. The [+ Add Field] button allows to add fields corresponding to Detail Type. Description: Free form text description of the line item that appears in the printed record. Max 4000 chars. Account Based Expense Line Detail: _ Account Reference: Reference to the Expense account associated with this item. ___ Account ID: The ID for the referenced account. ___ Name: Name derived from the field that holds the common name of that account. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘.⚠️ If this account has same location as specified in the transaction by the TransactionLocationType attribute and the same VAT as in the line item TaxCodeRef attribute, then this account is used.⚠️ If there is a mismatch, then the account from the account category list that matches the transaction location and VAT is used. ⚠️ If this account is not present in the account category list, then a new account is created with the new location, new VAT code, and all other attributes as in the default account. Item based Expense Line Detail: _ Quantity: Number of items for the line. _ Unit Price: Unit price of the subject item. _ Item Reference: : Reference to the Item. ___ Value: The ID for the referenced item. ___ Name: Name derived from the field that holds the common name of that item. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘._ Customer Reference: Reference to a customer or job. ___ Value: The ID for the referenced customer. ___ Name: Name derived from the field that holds the common name of that customer. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| ADDITIONAL FIELDS | |

| Currency Reference | Reference to the currency in which all amounts on the associated transaction are expressed. This must be defined if multi-currency is enabled for the company. Read more about multi-currency support here. [+ Add Field] add more fields: Value: A three letter string representing the ISO 4217 code for the currency. For example, USD, AUD, EUR. Name: The full name of the currency. |

| Ap Account Reference | Specifies to which AP account the bill is credited. [+ Add Field] add more fields: Value: The ID for the referenced account. Name: Name derived from the field that holds the common name of that account. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘.⚠️ The specified account must have Account.Classification set to Liability and Account.AccountSubType set to AccountsPayable. If the company has a single AP account, the account is implied. However, it is recommended that the AP Account be explicitly specified in all cases to prevent unexpected errors when relating transactions to each other. |

| Sales Term Reference | Reference to the Term associated with the transaction. [+ Add Field] add more fields: Value: The ID for the referenced sales term. Name: Name derived from the field that holds the common name of that sales term. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| Linked Transaction | Zero or more transactions linked to this Bill object. [⊕ Element][⊕ Map] Add fields or Map it from a Data Source. See Field Mapping. Additional Linked Transaction can be added as elements. Element 1: Represents the first Linked Transaction. Transaction ID: Unique identifier of the related transaction. Transaction Type: Possible values: BillPaymentCheck – A payment made by check to pay the bill.BillPaymentCreditCard – A payment made by credit card to pay the bill.CreditMemo – A credit memo applied to the bill.JournalEntry – A journal entry affecting the bill. |

| DocNumber | This field stores the transaction’s reference number. You can specify a custom value during creation. If none is provided this field is populated based on the setting of Preferences: CustomTxnNumber.▪️ If UseCustomTxnNumbers preference is enabled: You can provide a custom DocNumber. Duplicates are not allowed.▪️ If no custom value is given, DocNumber is null.▪️ If UseCustomTxnNumbers is disabled: DocNumber is automatically generated by the system.Cash/CreditCard: Duplicates always cause an error. Check: Duplicates cause an error only if the WarnDuplicateCheckNumber preference is enabled.Tips: Check the UseCustomTxnNumbers preference before setting DocNumber manually.Allow Duplicates: Use the include=allowduplicatedocnum query parameter to allow duplicate DocNumber (not recommended).Default Sort Order: Ascending order. |

(*) required field

Response Sample from Create Bill

{

"Bill": {

"SyncToken": "0",

"domain": "QBO",

"VendorRef": {

"name": "Bob's Burger Joint",

"value": "56"

},

"TxnDate": "2014-12-31",

"TotalAmt": 200.0,

"APAccountRef": {

"name": "Accounts Payable (A/P)",

"value": "33"

},

"Id": "151",

"sparse": false,

"Line": [

{

"DetailType": "AccountBasedExpenseLineDetail",

"Amount": 200.0,

"Id": "1",

"AccountBasedExpenseLineDetail": {

"TaxCodeRef": {

"value": "NON"

},

"AccountRef": {

"name": "Advertising",

"value": "7"

},

"BillableStatus": "NotBillable"

}

}

],

"Balance": 200.0,

"DueDate": "2014-12-31",

"MetaData": {

"CreateTime": "2014-12-31T09:59:18-08:00",

"LastUpdatedTime": "2014-12-31T09:59:18-08:00"

}

},

"time": "2014-12-31T09:59:17.449-08:00"

}

Create Sale Receipt Copy Link

The receipt specifies a deposit account for the received funds. If no deposit account is designated, the payment is directed to the Undeposited Account.

▪️ A SalesReceipt object must have at least one line that describes an item and an amount.

Tip: For Any Reference fields like Customer Reference, Account Reference or Vendor Reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Sales Receipt API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Sale Receipt creation. Additional fields: DocNumber. | |

| Line* The minimum line item required for the request is Sales Item Line or Group Line. | [⊕ Element][⊕ Map] Add fields or Map it from a Data Source. See Field Mapping. Additional Line can be added as elements. Element 1: Represents the first Line. Detail Type* Possible values for each line: Sales Item Line Detail Group Line Detail Description Line Detail Discount Line Detail Subtotal Line Detail Amount*: The amount of the line item. Sale Item Line Detail*: _ Item Reference*: : Reference to the Item. ___ Value*: The ID for the referenced item. ___ Name: Name derived from the field that holds the common name of that item. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘._ Unit Price: Unit price of the subject item as referenced by ItemRef._ Quantity: Number of items for the line. _ Tax Code Reference: Reference to the TaxCode for this item. [+ Add Field] add more fields: ___ Value: The ID for the referenced Tax Code. [+ Add Field] add more fields: Description: Free form text description of the line item that appears in the printed record. Max 4000 chars. |

| ADDITIONAL FIELDS | |

| DocNumber | This field stores the transaction’s reference number. You can specify a custom value during creation. If none is provided this field is populated based on the setting of Preferences: CustomTxnNumber.▪️ If UseCustomTxnNumbers preference is enabled: You can provide a custom DocNumber. Duplicates are not allowed.▪️ If no custom value is given, DocNumber is null.▪️ If UseCustomTxnNumbers is disabled: DocNumber is automatically generated by the system.Cash/CreditCard: Duplicates always cause an error. Check: Duplicates cause an error only if the WarnDuplicateCheckNumber preference is enabled.Tips: Check the UseCustomTxnNumbers preference before setting DocNumber manually.Allow Duplicates: Use the include=allowduplicatedocnum query parameter to allow duplicate DocNumber (not recommended).Default Sort Order: Ascending order. |

(*) required field

Response Sample from Create Sale Receipt

{

"SalesReceipt": {

"DocNumber": "1074",

"SyncToken": "0",

"domain": "QBO",

"Balance": 0,

"DepositToAccountRef": {

"name": "Undeposited Funds",

"value": "4"

},

"TxnDate": "2015-07-29",

"TotalAmt": 35.0,

"PrintStatus": "NeedToPrint",

"EmailStatus": "NotSet",

"sparse": false,

"Line": [

{

"Description": "Pest Control Services",

"DetailType": "SalesItemLineDetail",

"SalesItemLineDetail": {

"TaxCodeRef": {

"value": "NON"

},

"Qty": 1,

"UnitPrice": 35,

"ItemRef": {

"name": "Pest Control",

"value": "10"

}

},

"LineNum": 1,

"Amount": 35.0,

"Id": "1"

},

{

"DetailType": "SubTotalLineDetail",

"Amount": 35.0,

"SubTotalLineDetail": {}

}

],

"ApplyTaxAfterDiscount": false,

"CustomField": [

{

"DefinitionId": "1",

"Type": "StringType",

"Name": "Crew #"

}

],

"Id": "263",

"TxnTaxDetail": {

"TotalTax": 0

},

"MetaData": {

"CreateTime": "2015-07-29T09:25:02-07:00",

"LastUpdatedTime": "2015-07-29T09:25:02-07:00"

}

},

"time": "2015-07-29T09:25:04.214-07:00"

}

Create Estimate Copy Link

▪️ An Estimate must have at least one line that describes an item.

▪️ An Estimate must have a reference to a customer.

▪️ If shipping address and billing address are not provided, the address from the referenced Customer object is used.

Tip: For Any Reference fields like Customer Reference, Account Reference or Vendor Reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Estimate API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Estimate creation. Additional fields: Shipping Address, Customer Reference, Apply Tax After Discount. | |

| Customer Reference* | Reference to a customer or job. Customer ID*: The ID for the referenced customer. Name: Name derived from the field that holds the common name of that customer. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| Bill Email* | Identifies the e-mail address where the estimate is sent. Address*: An email address. The address format must follow the RFC 822 standard. |

| Line* | [⊕ Element][⊕ Map] Add fields or Map it from a Data Source. See Field Mapping. Additional Line can be added as elements. Element 1: Represents the first Line. Detail Type* Possible values : Sales Item Line Detail Group Line Detail Description Line Detail Discount Line Detail Subtotal Line Detail Amount*: The amount of the line item. Sale Item Line Detail*: _ Item Reference*: Reference to the Item. ___ Value*: The ID for the referenced item. ___ Name: Name derived from the field that holds the common name of that item. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘.[+ Add Field] add more fields: _ Unit Price: Unit price of the subject item as referenced by ItemRef._ Quantity: Number of items for the line. _ Tax Code Reference: Reference to the TaxCode for this item. [+ Add Field] add more fields: ___ Value: The ID for the referenced Tax Code. |

| ADDITIONAL FIELDS | |

| Customer Memo | Value*: User’s message to the customer; this message is visible to the end user on their transactions. Max 1000 chars. |

| Shipping Address | This field indicates the shipping address for the goods. If no specific shipping address is provided, QuickBooks will automatically use the default shipping address associated with the referenced customer in the system. When entering international addresses, specify the country using either the 3-letter ISO code (e.g., USA, GBR) or the full country name. [+ Add Field] add more fields: City Line1 Postal Code Latitude longitude Country Sub Division Code |

| Apply Tax After Discount apply to USA. | If false or null, calculate the sales tax first, and then apply the discount. If true, subtract the discount first and then calculate the sales tax. |

(*) required field

Response Sample from Create Estimate

{

"Estimate": {

"DocNumber": "1001",

"SyncToken": "0",

"domain": "QBO",

"TxnStatus": "Pending",

"BillEmail": {

"Address": "Cool_Cars@intuit.com"

},

"TxnDate": "2015-03-26",

"TotalAmt": 31.5,

"CustomerRef": {

"name": "Cool Cars",

"value": "3"

},

"CustomerMemo": {

"value": "Thank you for your business and have a great day!"

},

"ShipAddr": {

"CountrySubDivisionCode": "CA",

"City": "Half Moon Bay",

"PostalCode": "94213",

"Id": "104",

"Line1": "65 Ocean Dr."

},

"ProjectRef": {

"value": "39298034"

},

"PrintStatus": "NeedToPrint",

"BillAddr": {

"CountrySubDivisionCode": "CA",

"City": "Half Moon Bay",

"PostalCode": "94213",

"Id": "103",

"Line1": "65 Ocean Dr."

},

"sparse": false,

"EmailStatus": "NotSet",

"Line": [

{

"Description": "Pest Control Services",

"DetailType": "SalesItemLineDetail",

"SalesItemLineDetail": {

"TaxCodeRef": {

"value": "NON"

},

"Qty": 1,

"UnitPrice": 35,

"ItemRef": {

"name": "Pest Control",

"value": "10"

}

},

"LineNum": 1,

"Amount": 35.0,

"Id": "1"

},

{

"DetailType": "SubTotalLineDetail",

"Amount": 35.0,

"SubTotalLineDetail": {}

},

{

"DetailType": "DiscountLineDetail",

"Amount": 3.5,

"DiscountLineDetail": {

"DiscountAccountRef": {

"name": "Discounts given",

"value": "86"

},

"PercentBased": true,

"DiscountPercent": 10

}

}

],

"ApplyTaxAfterDiscount": false,

"CustomField": [

{

"DefinitionId": "1",

"Type": "StringType",

"Name": "Crew #"

}

],

"Id": "177",

"TxnTaxDetail": {

"TotalTax": 0

},

"MetaData": {

"CreateTime": "2015-03-26T13:25:05-07:00",

"LastUpdatedTime": "2015-03-26T13:25:05-07:00"

}

},

"time": "2015-03-26T13:25:05.473-07:00"

}

Create Deposit Copy Link

▪️ Customer payments previously held in the ‘Undeposited Funds’ account, now transferred to the designated Asset Account. This information is linked using the Deposit.line.LinkedTxn element.

▪️ New direct deposits, detailed within the Deposit.Line.DepositLineDetail section.

A deposit must include at least one deposit line, which can be either a direct deposit or a deposit linked to a previous transaction.

Multiple deposit lines of different types can be included in a single request.

For a direct deposit, each line must specify:

▪️ The target account (Deposit.Line.DepositLineDetail.AccountRef).

▪️ The overall deposit destination account (Deposit.DepositToAccountRef).

For a deposit linked to a previous transaction, each line must specify:

▪️ The linked transaction (Deposit.Line.LinkedTxn).

▪️ The overall deposit destination account (Deposit.DepositToAccountRef).

Tip: For Any Reference fields like Customer Reference, Account Reference or Vendor Reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Deposit API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Deposit creation. Additional fields: Deposit to Account Reference. | |

| Line* | [⊕ Element][⊕ Map] Add fields or Map it from a Data Source. See Field Mapping. Additional Line can be added as elements. Element 1: Represents the first Line. Detail Type*: Possible values : Deposit Line detail. Amount*: The amount of the deposit. Deposit Line Detail*: _ Account Reference*: Account where the funds are deposited. ___ Value*: The ID for the referenced account. ___ Name: Name derived from the field that holds the common name of that account. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| ADDITIONAL FIELDS | |

| Deposit to Account Reference | Identifies the account to be used for this deposit. [+ Add Field] add more fields: Value: The ID for the referenced account. Name: Name derived from the field that holds the common name of that account. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

(*) required field

Response Sample from Create Deposit

{

"Deposit": {

"SyncToken": "0",

"domain": "QBO",

"DepositToAccountRef": {

"name": "Checking",

"value": "35"

},

"TxnDate": "2014-12-22",

"TotalAmt": 20.0,

"sparse": false,

"Line": [

{

"DetailType": "DepositLineDetail",

"ProjectRef": {

"value": "42991284"

},

"LineNum": 1,

"Amount": 20.0,

"Id": "1",

"DepositLineDetail": {

"AccountRef": {

"name": "Unapplied Cash Payment Income",

"value": "87"

}

}

}

],

"Id": "149",

"MetaData": {

"CreateTime": "2014-12-22T14:46:36-08:00",

"LastUpdatedTime": "2014-12-22T14:46:36-08:00"

}

},

"time": "2014-12-22T14:46:36.084-08:00"

}

Create Credit Memo Copy Link

Tip: For Any Reference fields like Customer Reference, Account Reference or Vendor Reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Credit Memo API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Credit Memo creation. Additional fields: Customer Reference, Bill Email, Customer Memo, Bill Address, Shipping Address. | |

| Line* | [⊕ Element][⊕ Map] Add fields or Map it from a Data Source. See Field Mapping. Additional Line can be added as elements. Element 1: Represents the first Line. Detail Type*: Possible values: Sales Item Line Detail Group Line Detail Description Line Detail Discount Line Detail Subtotal Line Detail Amount*: The amount of the credit memo. Sales Item Line Detail*: _ Item Reference*: Reference to the Item. ___ Value*: The ID for the referenced item. ___ Name: Name derived from the field that holds the common name of that item. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| Customer Reference* | Reference to a customer or job. Customer ID*: The ID for the referenced customer. Name: Name derived from the field that holds the common name of that customer. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| ADDITIONAL FIELDS | |

| Bill Email | Identifies the e-mail address where the estimate is sent. [+ Add Field] add more fields: Address*: An email address. The address format must follow the RFC 822 standard.’ |

| Customer Memo | [+ Add Field] add more fields: Value: User’s message to the customer; this message is visible to the end user on their transactions. Max 1000 chars. |

| Bill Address | Bill-to address of the credit memo. If no specific bill address is provided, QuickBooks will automatically use the default billing address associated with the referenced customer in the system. When entering international addresses, specify the country using either the 3-letter ISO code (e.g., USA, GBR) or the full country name. [+ Add Field] add more fields: Line1 Line2 Line3 Line4 |

| Shipping Address | This field indicates the shipping address for the goods. If no specific shipping address is provided, QuickBooks will automatically use the default shipping address associated with the referenced customer in the system. When entering international addresses, specify the country using either the 3-letter ISO code (e.g., USA, GBR) or the full country name. [+ Add Field] add more fields: Country Sub Division Code City Postal Code line1 |

(*) required field

Response Sample from Create Credit Memo

{

"CreditMemo": {

"DocNumber": "1039",

"SyncToken": "0",

"domain": "QBO",

"Balance": 50.0,

"BillAddr": {

"City": "Half Moon Bay",

"Line1": "65 Ocean Dr.",

"PostalCode": "94213",

"Lat": "37.4300318",

"Long": "-122.4336537",

"CountrySubDivisionCode": "CA",

"Id": "4"

},

"TxnDate": "2014-12-31",

"TotalAmt": 50.0,

"CustomerRef": {

"name": "Cool Cars",

"value": "3"

},

"ShipAddr": {

"City": "Half Moon Bay",

"Line1": "65 Ocean Dr.",

"PostalCode": "94213",

"Lat": "37.4300318",

"Long": "-122.4336537",

"CountrySubDivisionCode": "CA",

"Id": "4"

},

"RemainingCredit": 50.0,

"PrintStatus": "NeedToPrint",

"ProjectRef": {

"value": "39298034"

},

"EmailStatus": "NotSet",

"sparse": false,

"Line": [

{

"LineNum": 1,

"Amount": 50.0,

"SalesItemLineDetail": {

"TaxCodeRef": {

"value": "NON"

},

"ItemRef": {

"name": "Concrete",

"value": "3"

}

},

"Id": "1",

"DetailType": "SalesItemLineDetail"

},

{

"DetailType": "SubTotalLineDetail",

"Amount": 50.0,

"SubTotalLineDetail": {}

}

],

"ApplyTaxAfterDiscount": false,

"CustomField": [

{

"DefinitionId": "1",

"Type": "StringType",

"Name": "Crew #"

}

],

"Id": "150",

"TxnTaxDetail": {

"TotalTax": 0

},

"MetaData": {

"CreateTime": "2014-12-31T09:44:40-08:00",

"LastUpdatedTime": "2014-12-31T09:44:40-08:00"

}

},

"time": "2014-12-31T09:44:40.726-08:00"

}

Create Purchase Order Copy Link

Tip: For Any Reference fields like Customer reference, Account reference or Vendor reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Purchase Order API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Purchase Order creation. Additional fields: AP Account Reference, Vendor Reference, DocNumber. | |

| Line* | [⊕ Element][⊕ Map] Add fields or Map it from a Data Source. See Field Mapping. Additional Line can be added as elements. Element 1: Represents the first Line. Detail Type* Value: Item based Expense Line Detail, Account Based Expense Line Detail. Amount*: amount, price of the line. Item Based Expense Line Detail* _ Item Reference*: Reference to the Item. ___ Value*: The ID for the referenced item. ___ Name: Name derived from the field that holds the common name of that item. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘._ Customer Reference*: Reference to a customer or job. ___ Value*: The ID for the referenced customer. ___ Name: Name derived from the field that holds the common name of that customer. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘._ Quantity*: Number of items. _ Item Reference*: Reference to the Item. ___ Value*: The ID for the referenced item. _ Billable Status: The billable status of the expense. This field is not updatable through an API request. The value automatically changes when an invoice is created. Possible values: Billable, Not Billable, Has Been Billed _ Unit Price: Unit price of the subject item as referenced by ItemRef. Corresponds to the Rate column on the QuickBooks Online UI to specify either unit price, a discount, or a tax rate for item. If used for unit price, the monetary value of the service or product, as expressed in the home currency. If used for a discount or tax rate, express the percentage as a fraction. For example, specify 0.4 for 40% tax. |

| AP Account Reference* | This field indicates the Accounts Payable (AP) account used to record the bill. While many small businesses may only have one AP account, it’s crucial to always explicitly specify the account. This ensures accurate record-keeping, especially for businesses with multiple AP accounts. The specified account must be a Liability account specifically designated for Payables. Failing to explicitly specify the AP account can lead to unexpected errors when linking transactions within your accounting system. [+ Add Field] add more fields: Value: The ID for the referenced account. Name: Name derived from the field that holds the common name of that account. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| Vendor Reference* | Reference to the vendor for this transaction. [+ Add Field] add more fields: Value: The ID for the referenced vendor. Name: Name derived from the field that holds the common name of that vendor. For example, when referencing a Customer object, the field used is ‘ Customer.DisplayName‘. |

| ADDITIONAL FIELDS | |

| DocNumber | This field stores the transaction’s reference number. You can specify a custom value during creation. If none is provided this field is populated based on the setting of Preferences: CustomTxnNumber.▪️ If UseCustomTxnNumbers preference is enabled: You can provide a custom DocNumber. Duplicates are not allowed.▪️ If no custom value is given, DocNumber is null.▪️ If UseCustomTxnNumbers is disabled: DocNumber is automatically generated by the system.Cash/CreditCard: Duplicates always cause an error. Check: Duplicates cause an error only if the WarnDuplicateCheckNumber preference is enabled.Tips: Check the UseCustomTxnNumbers preference before setting DocNumber manually.Allow Duplicates: Use the include=allowduplicatedocnum query parameter to allow duplicate DocNumber (not recommended).Default Sort Order: Ascending order. |

(*) required field

Response Sample from Create Purchase Order

{

"PurchaseOrder": {

"DocNumber": "1007",

"SyncToken": "0",

"domain": "QBO",

"VendorRef": {

"name": "Hicks Hardware",

"value": "41"

},

"TxnDate": "2015-07-28",

"TotalAmt": 25.0,

"APAccountRef": {

"name": "Accounts Payable (A/P)",

"value": "33"

},

"EmailStatus": "NotSet",

"sparse": false,

"Line": [

{

"DetailType": "ItemBasedExpenseLineDetail",

"Amount": 25.0,

"ProjectRef": {

"value": "39298034"

},

"Id": "1",

"ItemBasedExpenseLineDetail": {

"ItemRef": {

"name": "Pump",

"value": "11"

},

"CustomerRef": {

"name": "Cool Cars",

"value": "3"

},

"Qty": 1,

"TaxCodeRef": {

"value": "NON"

},

"BillableStatus": "NotBillable",

"UnitPrice": 25

}

}

],

"CustomField": [

{

"DefinitionId": "1",

"Type": "StringType",

"Name": "Crew #"

},

{

"DefinitionId": "2",

"Type": "StringType",

"Name": "Sales Rep"

}

],

"Id": "259",

"MetaData": {

"CreateTime": "2015-07-28T16:06:03-07:00",

"LastUpdatedTime": "2015-07-28T16:06:03-07:00"

}

},

"time": "2015-07-28T16:06:04.864-07:00"

}

Create Customer Copy Link

Customer Relationships: Customer relationships can be complex. Some customers may have a hierarchical structure. For example:

▪️ A team is the main customer, and its individual members are sub-customers.

▪️ A property management company is the main customer, and the properties they manage are sub-customers.

Tracking Work: You can use the system to track specific tasks or projects associated with a customer. For instance:

▪️ A homeowner is the customer, and their kitchen remodel is the project with individual tasks.

▪️ A car owner is the customer, and their car repairs are the projects with individual tasks.

⚠️ The Display Name attribute or at least one of Title, Given Name, Middle Name, Family Name, or Suffix attributes is required during customer creation.

Tip: For Any Reference fields like Customer reference, Account reference or Vendor reference, etc…, get the Value ID and Name by using Wiresk Method “List” or Trigger “Get Records by Search String” to determine the appropriate object for this reference.

See Quickbooks Customer API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Customer creation. Additional fields: Primary Email Address, Suffix, Title, Middle Name, Notes, Primary Phone, Company Name, Bill Address, Given Name. | |

| Family Name* | Family name or the last name of the person. |

| Display Name* | The Display Name is how the person or organization is identified within the system. It must be unique within the system (across Customers, Vendors, and Employees). This field cannot be removed using sparse updates.If not provided, the system will create one for you by combining the customer’s name components (like title, first name, last name). |

| ADDITIONAL FIELDS | |

| Primary Email Address | Primary email address. [+ Add Field] add more fields. Address: An email address, the format must follow the RFC 822 standard. |

| Suffix | Suffix of the name. For example, Jr. |

| Title | Title of the person. This tag supports i18n (localized translations of titles such as “Mr.,” “Ms.,” “Dr.,” “Prof.,” or job-related titles like “CEO” and “Manager” in different languages and cultures). |

| Middle Name | Middle name of the person. The person can have zero or more middle names. |

| Notes Max 2000 chars. | Free form text describing the Customer. |

| Primary Phone Max 30 chars. | Primary phone number. [+ Add Field] add more fields. Free for Number. |

| Company Name | The name of the company associated with the person or organization. |

| Bill Address | Default billing address. When a physical address is updated within a transaction object, the QuickBooks Online API organizes the address components differently in the transaction response compared to when it was initially created: The Line1 and Line2 fields are now filled with the customer name and company name. The original Line1 to Line5, along with City, SubDivisionCode (State/Province), and PostalCode, are shifted into Line3 through Line5 as free-form text. [+ Add Field] add more fields. Country Sub Division Code City Postal Code line1 Country |

| Given Name | Given name or first name of a person. |

(*) required field

Response Sample from Create Customer

{

"Customer": {

"domain": "QBO",

"PrimaryEmailAddr": {

"Address": "jdrew@myemail.com"

},

"DisplayName": "King's Groceries",

"CurrencyRef": {

"name": "United States Dollar",

"value": "USD"

},

"DefaultTaxCodeRef": {

"value": "2"

},

"PreferredDeliveryMethod": "Print",

"GivenName": "James",

"FullyQualifiedName": "King's Groceries",

"BillWithParent": false,

"Title": "Mr",

"Job": false,

"BalanceWithJobs": 0,

"PrimaryPhone": {

"FreeFormNumber": "(555) 555-5555"

},

"Taxable": true,

"MetaData": {

"CreateTime": "2015-07-23T10:58:12-07:00",

"LastUpdatedTime": "2015-07-23T10:58:12-07:00"

},

"BillAddr": {

"City": "Mountain View",

"Country": "USA",

"Line1": "123 Main Street",

"PostalCode": "94042",

"CountrySubDivisionCode": "CA",

"Id": "112"

},

"MiddleName": "B",

"Notes": "Here are other details.",

"Active": true,

"Balance": 0,

"SyncToken": "0",

"Suffix": "Jr",

"CompanyName": "King Groceries",

"FamilyName": "King",

"PrintOnCheckName": "King Groceries",

"sparse": false,

"Id": "67"

},

"time": "2015-07-23T10:58:12.099-07:00"

}

Create Vendor Copy Link

⚠️ The Display Name attribute or at least one of Title, Given Name, Middle Name, Family Name, or Suffix attributes is required during customer creation.

See Quickbooks Vendor API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Vendor creation. Additional fields: Print on Check Name, Primary Email Address, Suffix, Title, Tax Identifier, Account Number, Primary Phone, Web Address, Mobile, Company Name, Bill Address, Given Name. | |

| Family Name* | Family name or the last name of the person. |

| Display Name | The Display Name is how the person or organization is identified within the system. It must be unique within the system (across Customers, Vendors, and Employees). This field cannot be removed using sparse updates.If not provided, the system will create one for you by combining the customer’s name components (like title, first name, last name). |

| ADDITIONAL FIELDS | |

| Print on Check Name | This field displays the name of the person or organization as it should appear on a printed check. If you don’t provide this name, it will be automatically filled in using the DisplayName. |

| Primary Email Address | Primary email address. [+ Add Field] add more fields. Address: Email address, the format must follow the RFC 822 standard. |

| Suffix | Suffix of the name. For example, Jr. |

| Title | Title of the person. This tag supports i18n (localized translations of titles such as “Mr.,” “Ms.,” “Dr.,” “Prof.,” or job-related titles like “CEO” and “Manager” in different languages and cultures). |

| Tax Identifier Max 20 chars. | The tax ID of the Person or Organization. The value is masked in responses, exposing only last four characters. For example, the ID of 123-45-6789 is returned as XXXXXXX6789. |

| Account Number Max 100 chars. | Name or number of the account associated with this vendor. |

| Primary Phone | Primary phone number. [+ Add Field] add more fields. Free for Number. Max 30 chars. |

| Web Address Maximum 1000 chars. | [+ Add Field] add more fields. URI: Uniform Resource Identifier for the web site. |

| Mobile Maximum of 30 chars. | Mobile phone number. [+ Add Field] add more fields. Free for Number: Specifies the telephone number in free form. |

| Company Name | The name of the company associated with the person or organization. |

| Bill Address | Default billing address. When a physical address is updated within a transaction object, the QuickBooks Online API organizes the address components differently in the transaction response compared to when it was initially created: The Line1 and Line2 fields are now filled with the customer name and company name. The original Line1 to Line5, along with City, SubDivisionCode (State/Province), and PostalCode, are shifted into Line3 through Line5 as free-form text. [+ Add Field] add more fields. Country Sub Division Code City Postal Code line1 Country |

| Given Name | Given name or first name of a person. |

(*) required field

Response Sample from Create Vendor

{

"Vendor": {

"domain": "QBO",

"PrimaryEmailAddr": {

"Address": "dbradley@myemail.com"

},

"DisplayName": "Dianne's Auto Shop",

"CurrencyRef": {

"name": "United States Dollar",

"value": "USD"

},

"GivenName": "Dianne",

"Title": "Ms.",

"PrimaryPhone": {

"FreeFormNumber": "(650) 555-2342"

},

"Active": true,

"MetaData": {

"CreateTime": "2015-07-28T12:51:21-07:00",

"LastUpdatedTime": "2015-07-28T12:51:21-07:00"

},

"Vendor1099": false,

"BillAddr": {

"City": "Millbrae",

"Country": "U.S.A",

"Line3": "29834 Mustang Ave.",

"Line2": "Dianne Bradley",

"Line1": "Dianne's Auto Shop",

"PostalCode": "94030",

"CountrySubDivisionCode": "CA",

"Id": "423"

},

"Mobile": {

"FreeFormNumber": "(650) 555-2000"

},

"WebAddr": {

"URI": "http://DiannesAutoShop.com"

},

"Balance": 0,

"SyncToken": "0",

"Suffix": "Sr.",

"CompanyName": "Dianne's Auto Shop",

"FamilyName": "Bradley",

"TaxIdentifier": "99-5688293",

"AcctNum": "35372649",

"PrintOnCheckName": "Dianne's Auto Shop",

"sparse": false,

"Id": "137"

},

"time": "2015-07-28T12:51:21.326-07:00"

}

Create Account Copy Link

▪️ Money coming in: Income and revenue.

▪️ Money going out: Expenses.

▪️ The value of your assets: Things your business owns like vehicles and equipment.

There are five main types of accounts: assets, liabilities, income, expenses, and equity.

All your business’s accounts are listed in your Chart of Accounts, which is a unique list created for your specific business. Accountants often refer to these accounts as “ledgers.”

The “account object” is the tool you’ll use within the QuickBooks system to manage and work with your accounts.

See Quickbooks Account API reference.

| MAP FIELDS [+ Add Field] Select fields from list, to configure the Account creation. Additional fields: Currency reference, Meta Data, Current Balance, Active, Sub Account. | |

| Name* Must be unique. max 100 characters. | Name for the Account. Account.Name attribute must not contain double quotes (“) or colon (:). |

| Account Sub Type* | The account sub-type classification and is based on the AccountType value. Required if AccountType is not specified. See possible values in the Account type and Account Sub Type List below. |

| Account Type* | A detailed account classification that specifies the use of this account. The type is based on the Classification. Required if AccountSubType is not specified. See possible values in the Account type and Account Sub Type List below. |

| ADDITIONAL FIELDS | |

| Currency reference | Reference to the currency in which this account holds amounts. [+ Add Field] add more fields: Value: A three letter string representing the ISO 4217 code for the currency. For example, USD, AUD, EUR. Name: The full name of the currency |

| Meta Data | Descriptive information about the entity. The MetaData values are set by Data Services and are read only for all applications. [+ Add Field] add more fields. Create Time: Time the entity was created in the source domain. Local time zone: YYYY-MM-DDTHH:MM:SS UTC: YYYY-MM-DDT HH :MM: SSZ Specific time zone: YYYY-MM-DDT HH :MM:SS +/- HH :MM Last Update Time: Time the entity was last updated in the source domain. Local time zone: YYYY-MM-DDTHH:MM:SS UTC: YYYY-MM-DDT HH :MM: SSZ Specific time zone: YYYY-MM-DDT HH :MM:SS +/- HH :MM |

| Current Balance | Specifies the balance amount for the current Account. Valid for Balance Sheet accounts. |

| Active | True – False Inactive accounts can be hidden from most views and may not be used for new transactions. |

(*) required field

Account Type and Account Sub Type List

ASSET ACCOUNTS

| ACCOUNT TYPE | ACCOUNT SUB TYPE |

|---|---|

| Bank | Default CashOnHand (default), Checking, MoneyMarket, RentsHeldInTrust, Savings, TrustAccounts, CashAndCashEquivalents, OtherEarMarkedBankAccounts |

| Other Current Asset | Default AllowanceForBadDebts, DevelopmentCosts, EmployeeCashAdvances (default), OtherCurrentAssets, Inventory, Investment_MortgageRealEstateLoans, Investment_Other, Investment_TaxExemptSecurities, Investment_USGovernmentObligations, LoansToOfficers, LoansToOthers, LoansToStockholders, PrepaidExpenses, Retainage, UndepositedFunds, AssetsAvailableForSale, BalWithGovtAuthorities, CalledUpShareCapitalNotPaid, ExpenditureAuthorisationsAndLettersOfCredit, GlobalTaxDeferred, GlobalTaxRefund, InternalTransfers, OtherConsumables, ProvisionsCurrentAssets, ShortTermInvestmentsInRelatedParties, ShortTermLoansAndAdvancesToRelatedParties, TradeAndOtherReceivables |

| Fixed Asset | Default AccumulatedDepletion, AccumulatedDepreciation, DepletableAssets, FixedAssetComputers, FixedAssetCopiers, FixedAssetFurniture, FixedAssetPhone, FixedAssetPhotoVideo, FixedAssetSoftware, FixedAssetOtherToolsEquipment, FurnitureAndFixtures (default), Land, LeaseholdImprovements, OtherFixedAssets, AccumulatedAmortization, Buildings, IntangibleAssets, MachineryAndEquipment, Vehicles, AssetsInCourseOfConstruction, CapitalWip, CumulativeDepreciationOnIntangibleAssets, IntangibleAssetsUnderDevelopment, LandAsset, NonCurrentAssets, ParticipatingInterests, ProvisionsFixedAssets |

| Other Asset | Default LeaseBuyout, OtherLongTermAssets, SecurityDeposits, AccumulatedAmortizationOfOtherAssets, Goodwill, Licenses (default), OrganizationalCosts, AssetsHeldForSale, AvailableForSaleFinancialAssets, DeferredTax, Investments, LongTermInvestments, LongTermLoansAndAdvancesToRelatedParties, OtherIntangibleAssets, OtherLongTermInvestments, OtherLongTermLoansAndAdvances, PrepaymentsAndAccruedIncome, ProvisionsNonCurrentAssets |

| Accounts Receivable | Default Accounts Receivable |

EQUITY ACCOUNTS

| ACCOUNT TYPE | ACCOUNT SUB TYPE |

|---|---|

| Equity | Default OpeningBalanceEquity (default), PartnersEquity, RetainedEarnings, AccumulatedAdjustment, OwnersEquity, PaidInCapitalOrSurplus, PartnerContributions, PartnerDistributions, PreferredStock, CommonStock, TreasuryStock, EstimatedTaxes, Healthcare, PersonalIncome, PersonalExpense, AccumulatedOtherComprehensiveIncome, CalledUpShareCapital, CapitalReserves, DividendDisbursed, EquityInEarningsOfSubsidiaries, InvestmentGrants, MoneyReceivedAgainstShareWarrants, OtherFreeReserves, ShareApplicationMoneyPendingAllotment, ShareCapital, Funds |

EXPENSE ACCOUNTS

| ACCOUNT TYPE | ACCOUNT SUB TYPE |

|---|---|

| Expense | Default AdvertisingPromotional, BadDebts, BankCharges, CharitableContributions, CommissionsAndFees, Entertainment, EntertainmentMeals, EquipmentRental, FinanceCosts, GlobalTaxExpense, Insurance, InterestPaid, LegalProfessionalFees, OfficeExpenses, OfficeGeneralAdministrativeExpenses, OtherBusinessExpenses, OtherMiscellaneousServiceCost, PromotionalMeals, RentOrLeaseOfBuildings, RepairMaintenance, ShippingFreightDelivery, SuppliesMaterials, Travel (default), TravelMeals, Utilities, Auto, CostOfLabor, DuesSubscriptions, PayrollExpenses, TaxesPaid, UnappliedCashBillPaymentExpense, Utilities, AmortizationExpense, AppropriationsToDepreciation, BorrowingCost, CommissionsAndFees, DistributionCosts, ExternalServices, ExtraordinaryCharges, IncomeTaxExpense, LossOnDiscontinuedOperationsNetOfTax, ManagementCompensation, OtherCurrentOperatingCharges, OtherExternalServices, OtherRentalCosts, OtherSellingExpenses, ProjectStudiesSurveysAssessments, PurchasesRebates, ShippingAndDeliveryExpense, StaffCosts, Sundry, TravelExpensesGeneralAndAdminExpenses, TravelExpensesSellingExpense |

| Other Expense | Default Depreciation (default), ExchangeGainOrLoss, OtherMiscellaneousExpense, PenaltiesSettlements, Amortization, GasAndFuel, HomeOffice, HomeOwnerRentalInsurance, OtherHomeOfficeExpenses, MortgageInterest, RentAndLease, RepairsAndMaintenance, ParkingAndTolls, Vehicle, VehicleInsurance, VehicleLease, VehicleLoanInterest, VehicleLoan, VehicleRegistration, VehicleRepairs, OtherVehicleExpenses, Utilities, WashAndRoadServices, DeferredTaxExpense, Depletion, ExceptionalItems, ExtraordinaryItems, IncomeTaxOtherExpense, MatCredit, PriorPeriodItems, TaxRoundoffGainOrLoss |

| Cost of Goods Sold | Default EquipmentRentalCos, OtherCostsOfServiceCos, ShippingFreightDeliveryCos, SuppliesMaterialsCogs, CostOfLaborCos (default), CostOfSales, FreightAndDeliveryCost |

LIABILITY ACCOUNTS

| ACCOUNT TYPE | ACCOUNT SUB TYPE |

|---|---|

| Accounts Payable | Default Accounts Payable, OutstandingDuesMicroSmallEnterprise, OutstandingDuesOtherThanMicroSmallEnterprise |

| Credit Card | Default Credit Card |